We didn’t build another wallet. We built the right wallet.

A catalyst for growth offered by banks and credit unions.

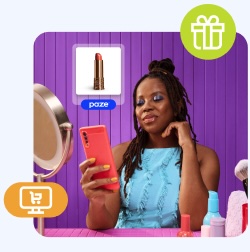

Paze online checkout + partner financial institutions =

Millions of ready shoppers.

From checkout button to growth engine.

Join the list of businesses offering Paze checkout to their customers.

See what our customers are saying about us.

Join the growing Paze network. Enable the future of payments for your merchants.

Stay in the know.

Get the latest stories and resources on Paze checkout.

1. Some merchants may require account setup to make purchases.

2. Equal to or more than $250M US based on e-commerce revenue, and MCC complaint (listed in the Rules). Eligible merchants must maintain a rolling fraud rate average of 10 basis points or below based on approved requirements. FLS program enhancements coming Q3 2025 and Q2 2026.