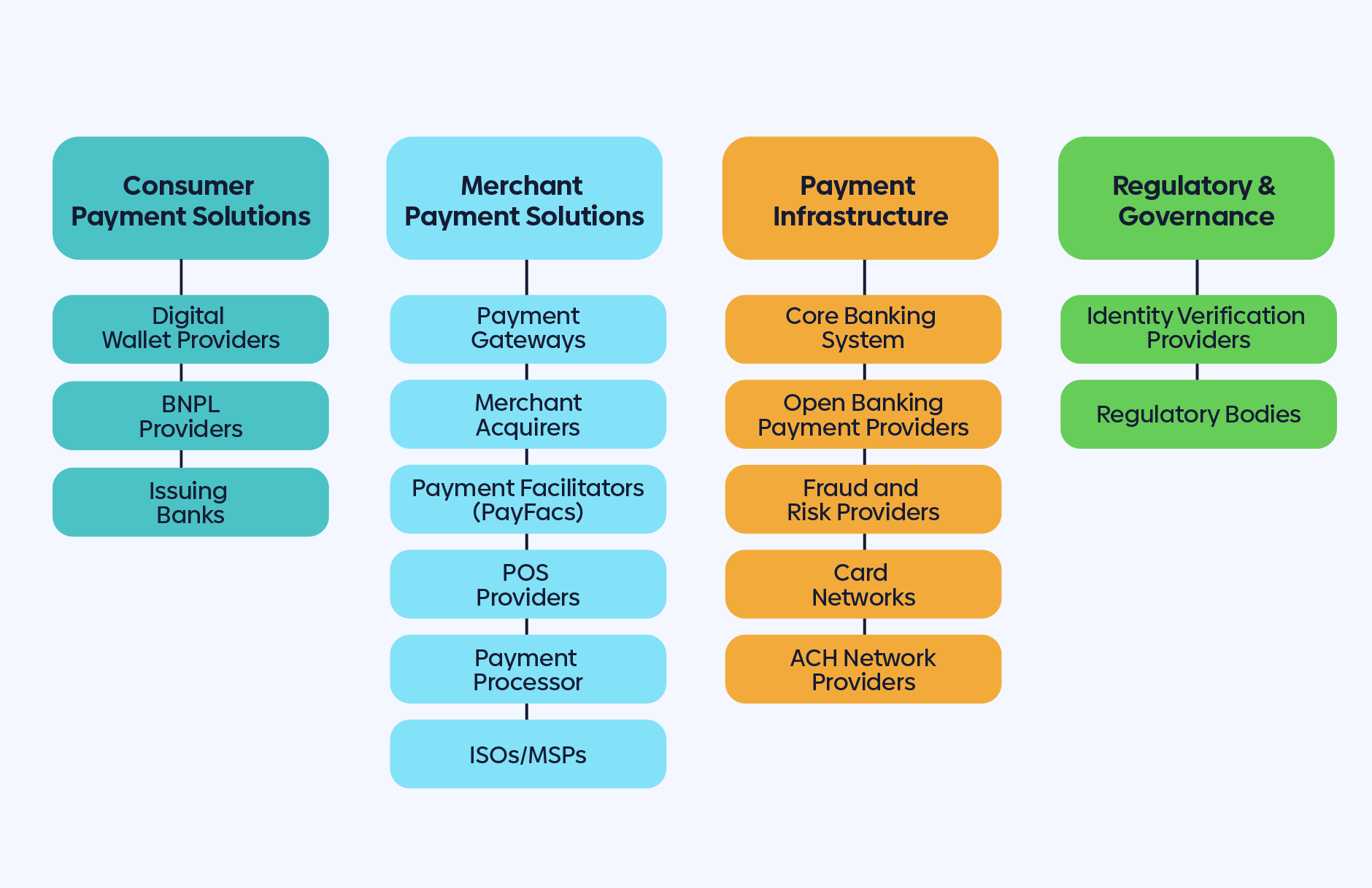

The e-commerce checkout process can feel straightforward to the consumer – they choose what to purchase, enter shipping and payment information, and the purchase is complete. But behind that simplicity lies a complex and interconnected ecosystem of players working together to facilitate the transaction. Understanding who these players are and their role is crucial for both consumers and merchants navigating the world of online payments.

Today, we’re breaking down the key stakeholders in the checkout process to help you understand who they are, how they interact, and how decisions are made at each level of the system.

Consumer Payment Solutions: Empowering the Buyer

These are the entities that provide consumers with the tools and methods to initiate payments. Their purpose is to make it easier for consumers to complete the checkout process.

Digital Wallet Providers

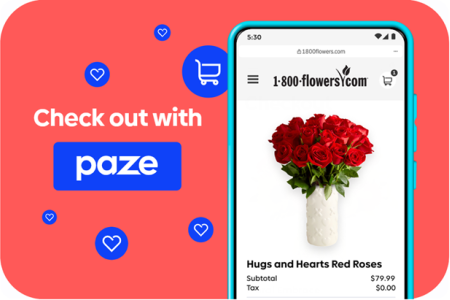

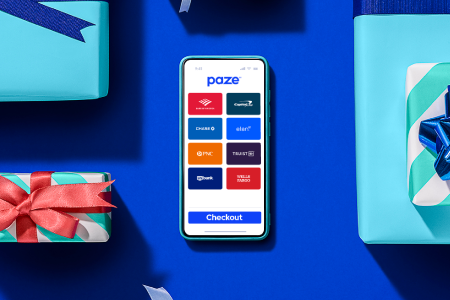

These platforms securely store consumers' payment information (credit cards, debit cards, bank account details) as well as consumer preference data (shipping address, contact info) to speed up the checkout process. They often use tokenization to enhance security, replacing sensitive card details with unique payment tokens that can only be used for a single transaction.

- Example: When you choose to check out with Paze, you're selecting a digital wallet that securely transmits your payment information to the merchant without exposing your actual card numbers.

BNPL Providers

Sometimes consumers want payment options beyond what traditional credit and debit cards may offer. Buy now, pay later (BNPL) services allow for installment payments so that large purchases can be paid in smaller increments over time.

- Example: Choosing Klarna or Affirm at checkout allows you to split your purchase into multiple interest-free installments.

Issuing Banks

Also known as issuers or financial institutions, these are the banks or credit unions that issue payment cards (credit and debit cards) directly to consumers. They hold the consumer’s funds (in the case of debit cards) or extend credit (in the case of credit cards). They are responsible for authorizing or declining transactions based on the cardholder’s available balance or credit limit.

- Example: Bank of America, Capital One, Chase, PNC, Truist, U.S. Bank, Wells Fargo, and regional credit unions are examples of issuers.

Merchant Payment Solutions: Enabling the Seller

Also known as Payment Service Providers (PSPs), merchant payment solutions empower businesses to accept various forms of payment, streamlining transactions and facilitating sales.

Payment Gateways

These act as a secure conduit between the merchant's website or app and the payment processor. They encrypt sensitive payment information during transmission, ensuring data security. You can think of them as the virtual point-of-sale terminal. When you enter your credit card details on an e-commerce website, the payment gateway securely transmits this information to the payment processor. Payment gateways minimize the merchant’s risk of handling payment data directly or storing payment data in merchant systems.

- Example: Stripe, Adyen, and Shopify are examples of payment gateways.

Payment Processors

These organizations handle the actual processing of the payment transaction, providing the infrastructure and services to move funds. They receive the transaction request from the payment gateway, route it to the appropriate card network and issuing bank for authorization, and then settle the funds to the merchant's account.

- Example: Square and Global Payments are examples of payment processors.

Merchant Acquirers (Acquiring Banks)

These financial institutions partner with payment processors to provide merchants with the ability to accept card payments. They establish the merchant account and handle the settlement of funds for merchants.

- Example: JPMorgan Chase, Bank of America, Fiserv, Worldpay, and Elavon are examples of merchant acquirers.

Payment Facilitators (PayFacs)

Payment Facilitators (PayFacs) have emerged as a significant model in the payment processing landscape, particularly for small and medium-sized businesses (SMBs) and online platforms. Some merchant categories have unique payment flows that are tightly connected to their customer experience. PayFacs provide specialized payment processing capabilities for specific merchant groups. For merchants that have too few payment transactions to qualify for their own merchant processing account, PayFacs aggregate them under their "master merchant account."

- Example: Shopify, Adyen, and Stripe are examples of payment facilitators.

POS Providers

Point Of Sale (POS) Providers offer the hardware and software solutions that businesses use to process in-person transactions at physical locations. These systems have evolved significantly from simple cash registers to sophisticated platforms that integrate various business functions beyond just payment processing.

- Example: Clover, Verifone, Hypercom, and Square are examples of POS providers.

ISOs/MSPs

In the context of merchant payment solutions, Independent Sales Organizations (ISOs) and Member Service Providers (MSPs) are often used interchangeably to describe third-party companies or individuals that partner with banks and card networks (like Visa and Mastercard) to sell and support merchant payment processing services to businesses. They essentially act as intermediaries, helping merchants set up accounts and providing the necessary tools and support to accept electronic payments.

- Example: Fiserv, Elavon, and TSYS are examples of ISOs or MSPs.

Payment Infrastructure: The Underlying Network

Payment infrastructure forms the essential, interconnected network of systems and providers that underpins all electronic payment transactions.

Core Banking Systems

Core banking systems represent the central processing hub for a bank’s essential operations, providing the technology infrastructure for banks to process payments daily.

- Example: FIS, Fiserv, and Jack Henry are examples of core banking systems.

Open Banking Payment Providers

Open banking payment providers enable direct bank-to-bank payments through open banking application programming interfaces (APIs), acting as intermediaries to initiate payments directly between a payer's bank account and a payee's bank account, with the explicit consent of the payer. This bypasses traditional card networks and other intermediaries, offering several potential advantages like lower transaction fees, faster settlement times, and enhanced security.

- Example: Trustly and Plaid are examples of open banking payment providers.

Fraud and Risk Providers

These prevent fraud and manage risk for bank payments and provide identity verification. They offer a range of technologies and services to detect, prevent, and mitigate fraudulent activities and manage various risks associated with financial transactions and user authentication.

- Example: Adyen, Fiserv, Stripe, Mastercard, and Visa are examples of fraud and risk providers.

Card Networks

Card networks are the essential infrastructure that facilitate, secure, and standardize payment transactions made with credit, debit, and prepaid cards between merchants and banks. They act as intermediaries, ensuring smooth communication and the transfer of funds between the various parties involved in a card transaction.

- Example: Visa, Mastercard, Discover, and American Express are examples of card networks.

ACH Network Providers

Automated clearing house (ACH) networks are electronic funds transfer systems that facilitate bank-to-bank transfers. ACH enables banks to push money from one of their bank accounts to an account at another bank (direct debits) as well as pull money from one bank account to another (direct credits). ACH is often used for recurring bill payments and payroll and is even used for settlement payments behind credit and debit card transactions. Zelle® participating banks also use ACH as an underlying money movement service for Zelle peer-to-peer payments.

- Example: The Clearing House and The Federal Reserve Banks operate ACH network payments.

Regulatory and Governance: Ensuring Trust and Security

Regulatory and governance entities establish the rules and oversight mechanisms that ensure the safety, security, and efficiency of payment systems.

Identity Verification Providers

These verify the identities of individuals and link their bank accounts for secure transactions. While there is some overlap with general Fraud and Risk Providers, these entities often have a specific focus on confirming who a user is and ensuring the legitimacy of the bank account they are using.

- Example: Plaid, Trustly, and Socure are examples of identity verification providers.

Regulatory Bodies

Regulatory bodies govern security, interoperability, and standards across the payment ecosystem. Government agencies like the Consumer Financial Protection Bureau (CFPB) establish regulations and enforce laws related to consumer protection, data privacy, and fair lending practices within the payments industry. The Payment Card Industry (PCI) Security Standards Council establishes and manages data security standards (PCI DSS) that organizations handling cardholder data must adhere to so they can prevent fraud and data breaches. Financial industry self-regulatory bodies like NACHA also establish rules and guidelines for specific payment methods (like ACH).

- Example: The PCI Security Standards Council establishes security standards for organizations handling cardholder data.

Paze Simplifies the Complexity

While the payments ecosystem involves many players, solutions like Paze aim to simplify the checkout experience for consumers. Through network tokenization, Paze securely stores payment information and enables automatic updates to card details.

Understanding the roles of these different players helps both consumers and merchants appreciate the intricacies that make digital payments possible. As the payments landscape continues to evolve with new technologies and regulations, staying informed about these key stakeholders will be more important than ever.

Interested in implementing Paze or establishing a partnership? Contact the Paze team.

at checkout?

at checkout?