Paze is the new way to check out online that makes it easy for you to make purchases. Offered by participating banks and credit unions - including seven of the nation’s largest banks – the Paze checkout experience makes it easy and convenient to shop with your favorite merchants online.

Unlike other digital wallets, checking out with Paze allows you to purchase online with eligible debit and credit cards from the financial institution you already use, without any manual entry. There’s no need to set up an account or download an app, and your card details are automatically kept up to date.

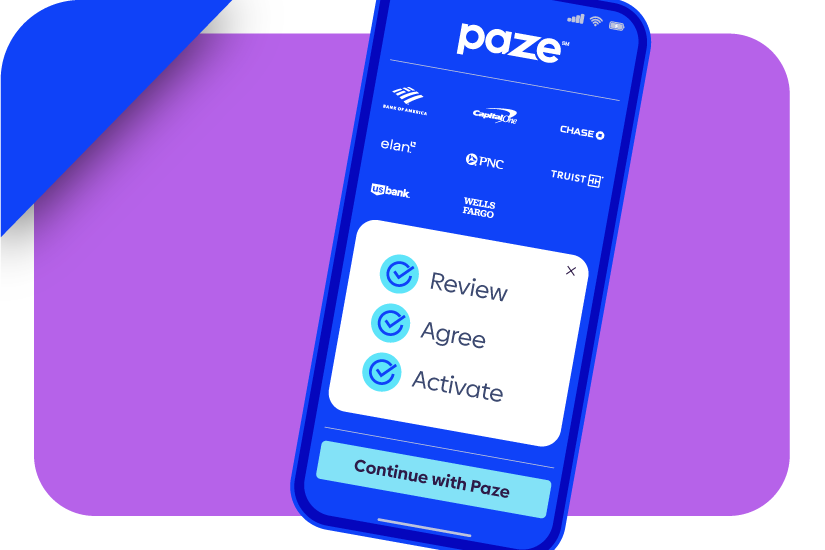

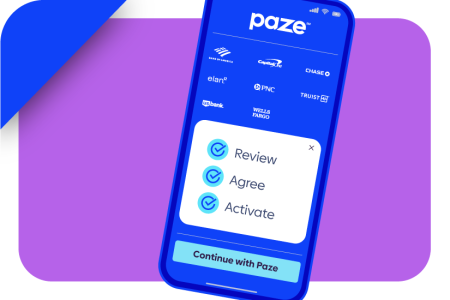

As soon as you activate your wallet, your cards are immediately available, eliminating the need for a tedious, lengthy and error-prone process. Your bank or credit union securely adds your cards to your digital wallet and uses encryption mechanisms like tokenization to share only the necessary details – never your actual card numbers – with a merchant to complete a transaction. All you need to do is activate Paze through a quick and simple process.

Be in control and activate your Paze wallet today to take advantage of all the benefits of this reimagined checkout solution.

How Paze is different

- No new app to download and no username or password1 to memorize. You simply select Paze to check out, authenticate with a one-time passcode, choose the card you wish to use, and confirm your selection.

- No need to manually add cards; they can be used immediately once you’ve activated Paze.

Benefits of activating Paze

- Additional layer of security through network tokenization – actual card numbers are never shared or stored with merchants [learn more about network tokenization].

- Network tokens, a random number produced to represent your card number, stay up to date automatically, so even if your card is lost or expired, you can still shop using Paze. It also means you can say goodbye to mistyped information and manual errors.

- Offered by the participating banks and credit unions that you already use, starting with Bank of America, Capital One, Chase, Elan, PNC, Truist, US Bank, and Wells Fargo – with more to come!

Learn how to activate Paze with this quick, simple process:

at checkout?

at checkout?