Merchants are far from one-size-fits-all. They don’t operate in a vacuum. They exist within distinct and interconnected digital environments and work with different players in the payment ecosystem depending on their complexity.

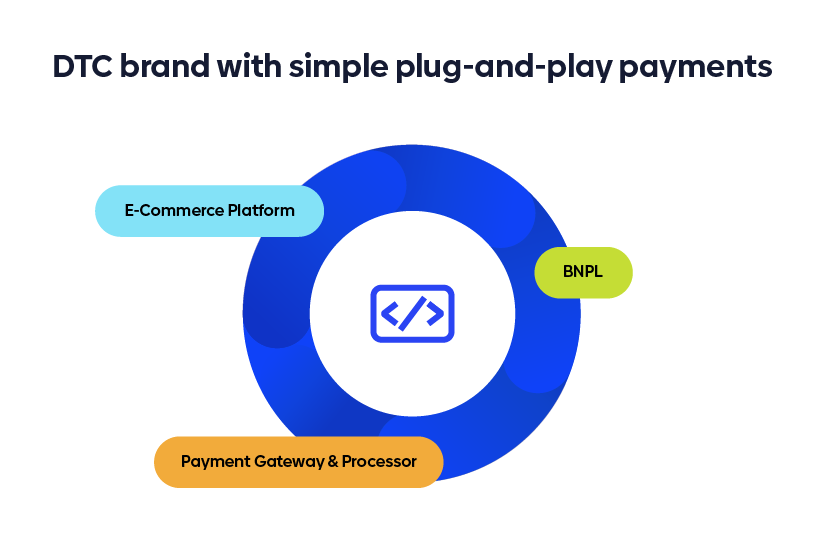

DTC brand with simple plug-and-play payments

Consider, for example, a direct-to-consumer (DTC) brand. Their approach is characterized by simplicity, ease of use, cost-effectiveness, and a focus on providing a smooth and trustworthy checkout experience for their customers. They often leverage the tools and integrations readily available through an e-commerce shopping platform and prioritize essential payment methods to get started and enable future growth. Their payment infrastructure evolves as their business scales and their needs become more complex.

1. Leveraging user-friendly e-commerce platforms:

- Small DTC brands often rely heavily on widely available all-in-one e-commerce platforms. These platforms provide built-in payment processing or seamless integrations with popular payment gateways that simplify setup and management.

- The key here is simplicity and ease of integration. They prioritize solutions that are quick to implement and don't require extensive technical expertise: think one-click integrations with payment providers.

2. Utilizing integrated payment gateways:

- Small DTC brands often use payment gateways due to their user-friendliness, relatively low barrier to entry, and wide acceptance. e-Commerce platforms often have direct integrations with these providers.

- Small brands appreciate transparent and straightforward fee structures. They might opt for standard processing fees without complex tiered pricing.

- While security is important, they often rely on the built-in security features provided by their chosen platform and payment gateway (e.g., PCI DSS compliance handled by the provider).

3. Focus on essential payment methods:

- Small DTC brands typically prioritize accepting major credit and debit cards as these broadly cover their customer base.

- They might offer alternative payment methods, including digital wallets like PazeSM, to streamline checkout and cater to mobile users, often enabled through their platform's integrations.

- Increasingly, small DTC brands are integrating Buy Now, Pay Later (BNPL) options to attract customers and potentially increase average order value, often through simple app integrations on their platform.

4. Prioritizing conversion and customer experience:

- A smooth and intuitive checkout process is crucial. Aiming for minimal steps and clear instructions helps reduce cart abandonment.

- Given the prevalence of mobile shopping, ensuring the payment process is optimized for mobile devices is a high priority.

- Displaying security badges along with clear return policies can help build customer trust, especially for newer brands.

5. Basic reporting and reconciliation:

- Basic sales and payment reports are often provided to small DTC brands by their e-commerce platform and payment gateway.

- For smaller volumes, reconciliation might involve manually comparing sales data with payment records. As DTC brands grow, they may explore more sophisticated accounting software integrations.

6. Cost-consciousness:

- Small DTC brands are often very sensitive to transaction fees. They will likely compare rates from different payment providers and choose options that align with their budget.

- They tend to avoid custom or complex payment integrations that require significant development costs.

7. Scalability for future growth:

- While starting simple, they often select platforms that can accommodate their future growth in terms of transaction volume and features.

- As they scale, they might gradually explore more advanced features like enhanced fraud detection or adding checkout options.

Online marketplace managing multiple sellers

Now, consider how an online marketplace consisting of numerous independent sellers might approach the management of e-commerce transactions directly with individual consumers. Marketplaces require a sophisticated and robust payment infrastructure that can handle the complexities of multiple parties, diverse payment flows, and stringent security and regulatory requirements. They often rely on specialized payment service providers that offer solutions tailored to these unique challenges.

1. Seller onboarding and verification (KYB – Know Your Business):

- Marketplaces need to verify the identity and legitimacy of each seller to help prevent fraud and comply with regulations like, for example, anti-money laundering (AML). They work with identity verification providers and fraud and risk providers to make this possible.

- This process can be complex and time-consuming, potentially leading to onboarding bottlenecks and seller drop-off.

2. Payment processing complexity:

- Unlike single-seller e-commerce sites, marketplaces handle payments from buyers or multiple sellers in a single transaction.

- They need systems to accurately split these payments, deduct commissions, and route the correct amounts to each seller.

- Supporting various payment methods preferred by both buyers and sellers across different regions adds complexity.

3. Payout management:

- Marketplaces must establish clear and reliable payout schedules for sellers (e.g., daily, weekly, monthly).

- Managing payments in different currencies outside the United States may be challenging.

- Ensuring timely and accurate payments is crucial for maintaining seller trust and satisfaction. Delays can negatively impact a seller’s cash flow.

4. Fee and commission management

- Marketplaces need to accurately calculate and deduct various fees, such as listing fees, transaction fees, and commission percentages, from seller earnings.

- This requires robust systems to track sales and apply the correct fee structures for different sellers or product categories.

5. Effectuating refunds and managing disputes:

- The refund process from a third-party seller requires clear processes.

- Disputes between buyers and sellers need to be mediated fairly, and the payment system must accommodate potential chargebacks or reversals.

6. Fraud prevention and security:

- Implementing robust fraud detection and prevention measures is essential to protect both buyers and sellers and maintain the marketplace's reputation. This includes secure payment gateways and transaction monitoring.

7. Regulatory compliance:

- Marketplaces must comply with a wide range of financial regulations, including payment processing standards (like PCI DSS) and; consumer protection laws.

- Staying up to date with evolving regulations and implementing necessary changes to payment systems can be a significant undertaking.

8. Reconciliation and reporting:

- Reconciling payments, fees, and payouts across numerous sellers and transactions is a complex accounting task.

- Providing sellers with clear and transparent reports on their sales, fees, and payments is crucial for building trust and facilitating their business management.

9. Scalability:

- As a marketplace grows, its payment processing infrastructure must be able to handle increasing transaction volumes and a growing number of sellers without compromising efficiency or security.

10. Integration with seller tools:

- Marketplaces often need to integrate their payment systems with various tools and services used by sellers, such as accounting software or inventory management systems, to streamline their operations.

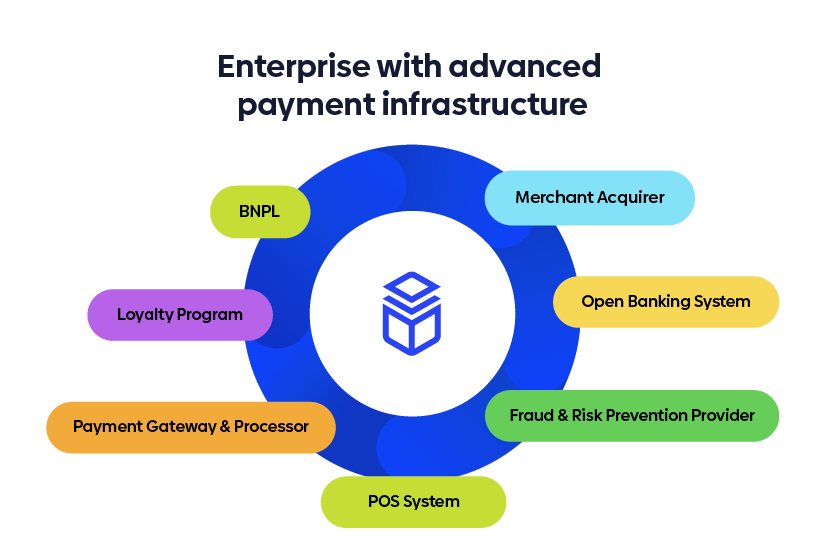

Enterprise with advanced payment infrastructure

Enterprise merchants view e-commerce payments not just as a transactional necessity but as a critical component of their overall business strategy. They invest in sophisticated infrastructure, prioritize security and compliance, and leverage data to optimize their payment processes, enhance the customer experience, and drive revenue growth on a global scale. Their approach is proactive, strategic, and focused on building a resilient and efficient payment ecosystem.

1. Emphasis on robust and scalable infrastructure:

- High-volume processing: Enterprise merchants handle a massive number of transactions, especially during peak sales periods. Their infrastructure is built for speed, reliability, and the ability to scale seamlessly without performance degradation. They often utilize multiple robust payment gateways and processors designed for enterprise-level throughput.

- Redundancy and reliability: Downtime can translate to notable financial losses. To help ensure continuous operation and high availability, enterprises may consider integrating failover mechanisms.

- Global reach: For those enterprise merchants that operate internationally, a solid infrastructure that can handle multiple currencies is essential.

2. Sophisticated payment gateways and processors:

- Direct integrations: Instead of relying solely on out-of-the-box solutions, they often have direct and customized integrations with major payment gateways and processors. This may allow for increased control; and tailored features, and may result in more favorable payment processing and gateway fees.

- Multiple payment method support: Enterprise merchants may offer different payment options, including digital wallets, local payment methods, and Buy Now, Pay Later (BNPL) services, catering to diverse customer preferences.

- Advanced features: Gateways and processors can often support advanced functionalities like tokenization for enhanced security, recurring billing for subscription services, and fraud management tools.

3. Layered security and compliance:

- PCI DSS Level 1 compliance: Enterprise merchants must adhere to the highest level of Payment Card Industry Data Security Standard (PCI DSS) compliance to protect sensitive customer data and avoid penalties.

- Advanced fraud prevention: Enterprise merchants require multi-layered fraud detection and prevention systems that go beyond basic security features. This might include AI-powered risk scoring, behavioral analytics, and integration with fraud intelligence networks.

- Data encryption and tokenization: Enterprise merchants need robust encryption to secure data. Tokenization provides one-time-use tokens instead of actual card numbers, which helps to prevent sensitive cardholder data from being exposed in potential data breaches.

- Regulatory compliance: These merchants have dedicated teams and systems to ensure compliance with various regional and international financial regulations, including GDPR and local payment processing rules.

4. Data-driven optimization:

- Advanced reporting and analytics: Sophisticated payment systems can generate rich data and other insights into payment performance for enterprise merchants, including authorization rates, transaction times, and reasons for failures. Enterprises can leverage this data to identify trends, optimize payment workflows, and improve customer experience.

- A/B testing and experimentation: Merchants often conduct A/B tests on different payment configurations, such as the order of payment methods or checkout flows, to help identify opportunities for higher conversion rates.

- Personalized payment experiences: By analyzing customer data, merchants can offer personalized payment options or promotions at checkout.

5. Streamlined reconciliation and accounting:

- Integration with ERP systems: Large merchants' payment infrastructure is tightly integrated with their Enterprise Resource Planning (ERP) and accounting systems for automated reconciliation of transactions, fees, and payouts.

- Centralized payment management: Enterprise merchants often work within centralized platforms or dashboards that provide a holistic view of all payment activities across different channels and regions.

6. Strategic partnerships:

- Collaboration with financial services technology companies: Enterprise merchants may strategically partner with specialized financial services technology companies to leverage their innovative payment solutions or gain access to niche payment methods.

As merchants navigate unique digital environments and an evolving payments landscape, solutions like PazeSM provide a forward-thinking approach to enhancing the customer purchasing experience and simplifying the checkout process.

Interested in implementing PazeSM or establishing a partnership? Contact the PazeSM team.

at checkout?

at checkout?