It's supposed to be the most wonderful time of the year – but for many, that can be an overstatement. Even without the stressors of travel during the busiest time of year and juggling family gatherings, holiday shopping has rarely been on the “Nice” list.

Although online shopping has been a lifesaver for those wishing to find fast deals and skip the crowds, it can be fraught with complications: Typing in addresses, entering credit card numbers, and trying to remember passwords is a far cry from festive. With Deloitte expecting 2025 e-commerce holiday season sales to be between $305 and $310.7 billion overall1, the online shopping experience needs to also be a stress-free shopping experience.

Consumers want speed, simplicity, and a checkout that just works

The typical online checkout can be a slog, usually requiring the painstaking manual entering of names, addresses, and credit or debit card numbers – an even bigger hassle on mobile devices, where much holiday shopping now happens (last year, Adobe predicted mobile to drive 53% of online sales). Throw in a sub-par mobile checkout experience, and merchants can miss crucial conversion opportunities during the most important e-commerce holiday season of the year.

Complexity kills sales

For customers who are already time-crunched, a clunky, long checkout experience just adds to holiday stress. By reducing barriers, merchants can reduce cart abandonment and maximize conversion during peak demand. During a season when shoppers are already wary of extra hassles, consumers are prioritizing a smooth, reliable payment (or checkout) experience, which can influence where and how they buy.

Merchant holiday wish list: Conversion and reliability

For those in e-commerce, the holiday season is the ultimate test. Merchants need to deliver seamless, efficient experiences that keep carts from being abandoned during the busiest time of the year. Merchants know they need to:

- Minimize abandoned carts caused by long or confusing checkouts.

- Provide bank-offered payments that match shopper preferences.2

- Deliver a low-friction experience with a fast, reliable checkout.

Partnering for a stress-free holiday checkout experience

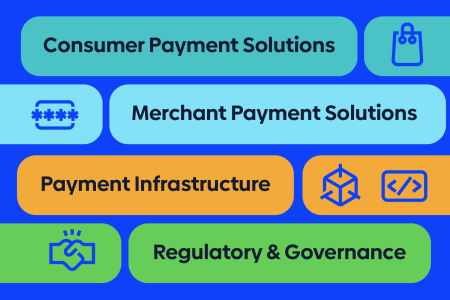

One of the most powerful ways merchants can alleviate holiday shopping stress is by streamlining the online checkout process and understanding the who’s who of the payment ecosystem. Like the holidays can be, the process may seem simple on its face, but is quite complex behind the scenes. Knowing who does what within this interconnected system can help merchants reduce friction and meet consumer expectations for speed, reliability, and flexibility during the holiday rush.

- Consumer payments solutions – provide consumers the tools and methods to initiate payments, making it easier for them to complete the checkout process.

- Merchant payments solutions – empower businesses to accept various forms of payments, streamlining transactions, and facilitating sales

- Payment infrastructure – forms the interconnected network of systems and providers essential for all electronic payment transactions.

- Regulatory and governance – establishes the rules and oversight to ensure safety, security, and efficiency of payment systems.

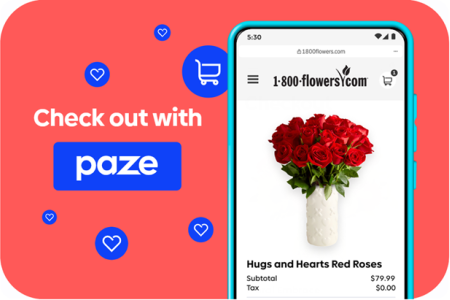

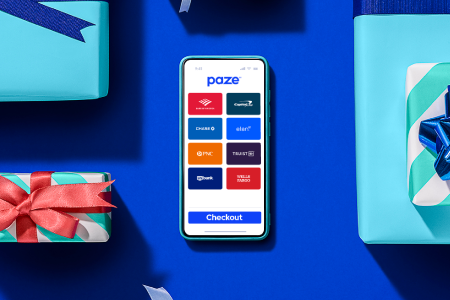

Solutions like PazeSM checkout help simplify the purchasing process by tokenizing a customer’s credit card number when communicating with a retailer’s online platform. As payments evolve, understanding the players behind the process helps merchants and consumers stay ahead.

Deliver a stress-free holiday experience with Paze

The holidays are hectic enough. The Paze checkout process helps make holiday shopping fast, simple, and reliable—for both shoppers and merchants.

- Speed: Shoppers can skip forms and guest checkout entirely. They can bypass signups and jump straight to fast checkout, helping reduce barriers to payment.

- Simplicity: Cards are already pre-loaded and automatically kept up to date with tokenization, so no more re-entering card numbers when eligible cards expire. There’s no new app to download, no new username or password to memorize, or card details to manually enter.

- Smart Payments: Instead of passing card numbers, Paze uses unique tokens with network tokenization. This can help reduce the risk of fraudulent charges because full card numbers aren’t visible in the checkout process, allowing consumers to check out efficiently.

- Bank-Offered: 82% of consumers trust their banks’ safety and security3. Paze is a powerful solution offered by banks and credit unions that customers already know and use.

Get Your Holiday PAZEPERKS

Ready to get the Paze checkout experience? From November 1 through December 31, 2025, Paze is pleased to offer some exciting discounts with the code PAZEPERKS:

- 30% off at 1-800-Flowers and Harry & David.*

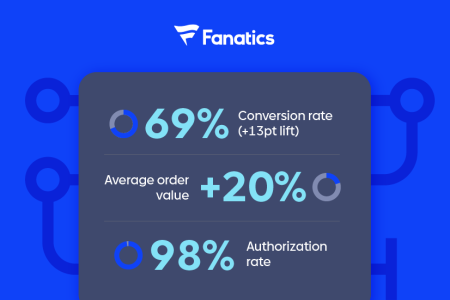

- 35% off + free shipping at Fanatics.*

Individual merchants’ terms apply. View the full Paze online merchant directory, including Roku, Sephora, Teleflora, NewEgg and ShopRite.

at checkout?

at checkout?