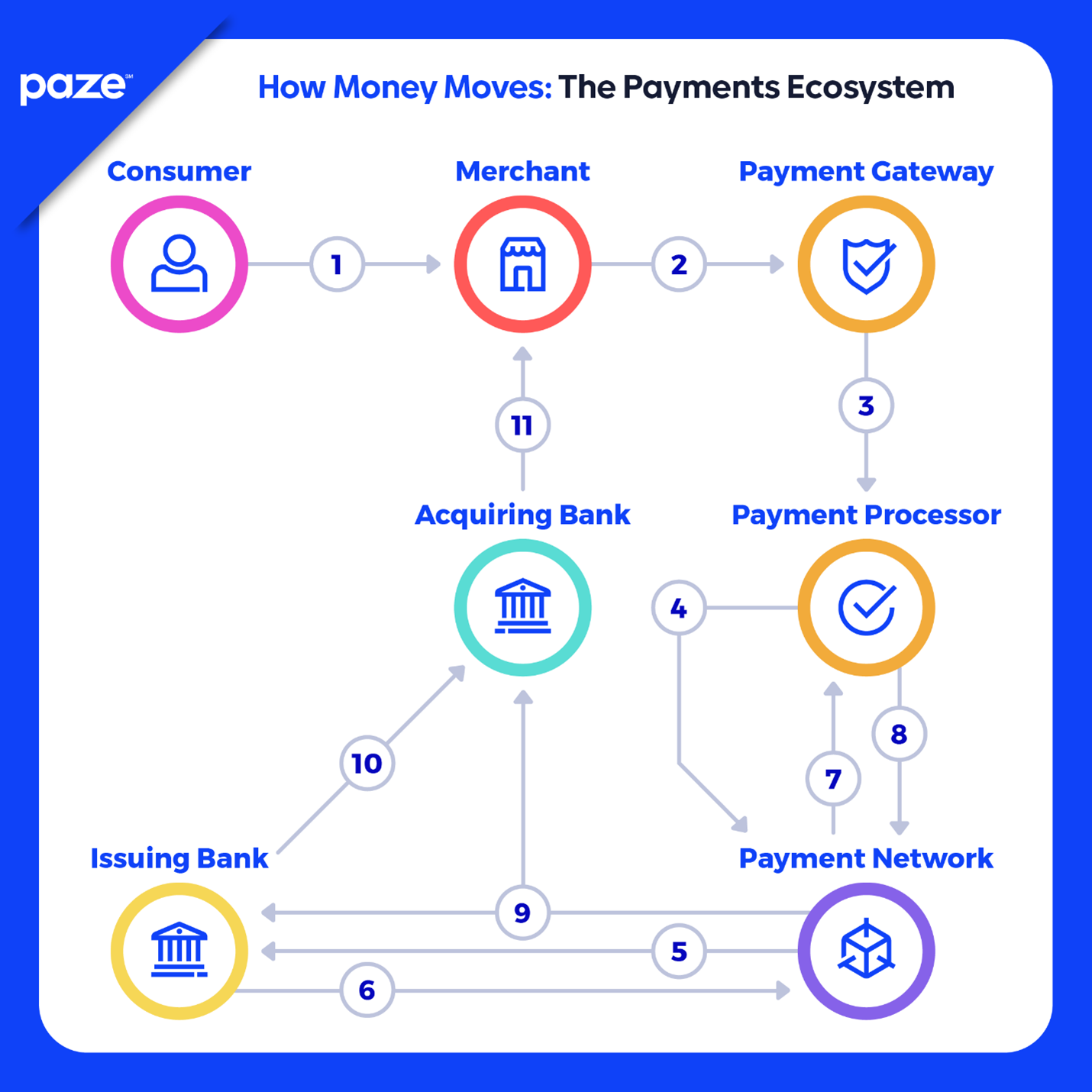

A single payment puts an entire network of players and a multistep process into motion. For merchants, navigating this landscape can be challenging; filled with potential friction points that impact customer experience and revenue. Different merchants have different needs, but their payments infrastructure universally considers these four steps:

- Checkout → Make it easy for the consumer!

- Authorization → Secure and reliable approvals are key.

- Settlement → Fast access to funds improves cash flow.

- Loyalty → Data-driven decisions drive customer loyalty.

This infographic displays the journey of a single digital payment and the players involved:

Let's take a closer look.

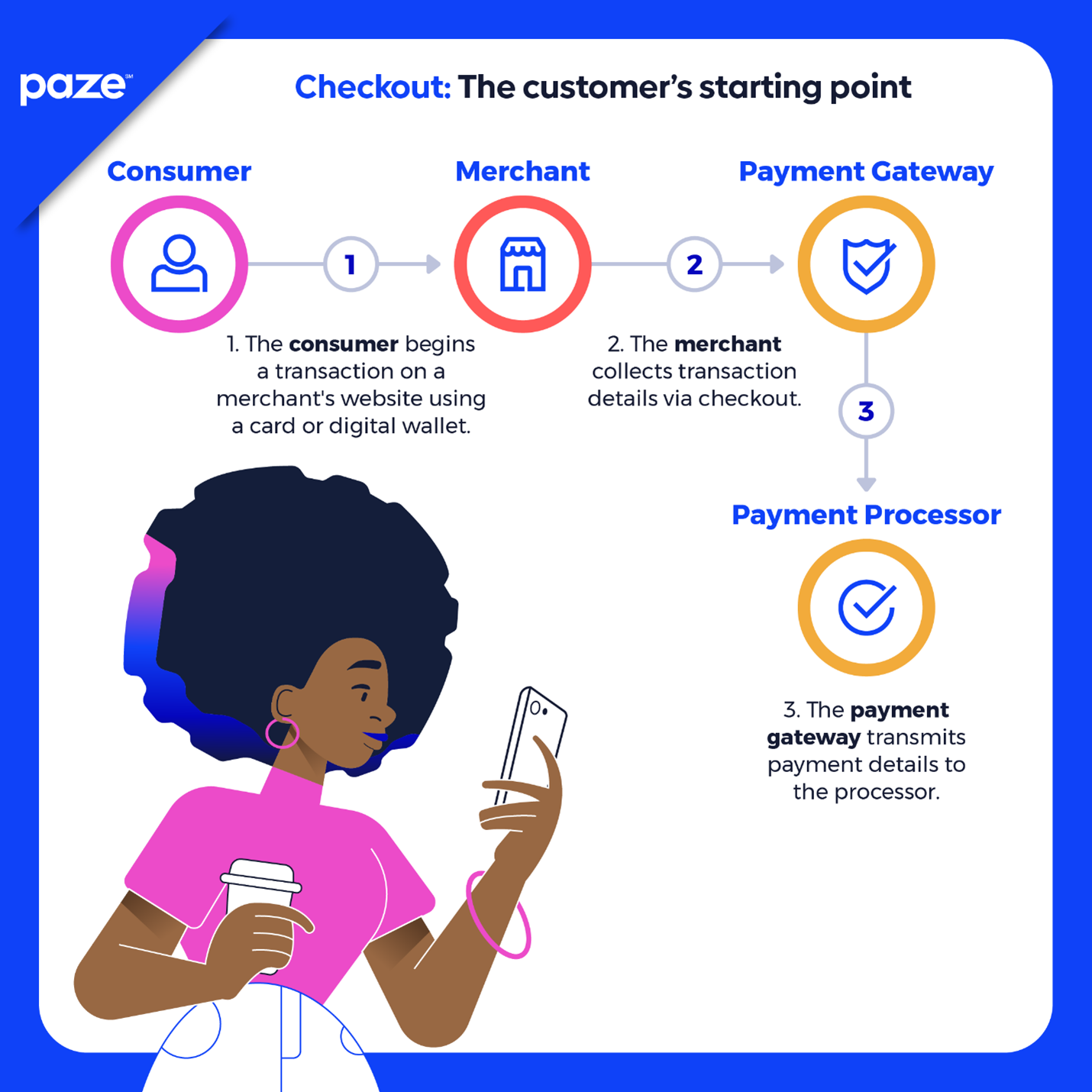

1. The checkout: The customer’s starting point

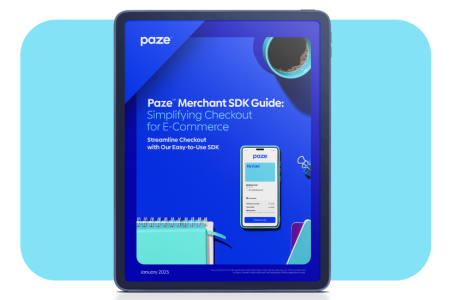

The initial interaction with the payment process begins at the checkout page. Here is where the customer provides their payment details, often through a digital wallet like Paze or by manually entering card information. A payment gateway plays the crucial role of collecting this sensitive data, encrypting it to safeguard against fraud, and transmitting the information to the payment processor.

2. Authorization: Seeking approval for the transaction

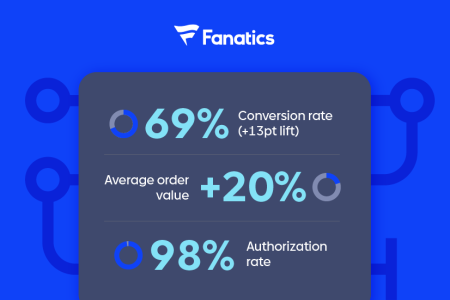

Once the payment information is captured, the authorization process begins. The payment processor acts as a bridge between the merchant, the card networks (like Visa, Mastercard, American Express, or Discover), and the consumer’s issuing bank (the financial institution that issued the customer’s credit or debit card). The issuing bank evaluates the transaction based on factors like the customer’s available funds or credit limit and their account standing. The issuing bank also looks for irregularities like an unusual merchant location, transaction size, or merchant type. Within seconds, the issuing bank responds with an approval or decline code. This response travels back through the card network to the payment processor and finally to the merchant’s acquiring bank (the bank that holds the merchant’s account), confirming whether the transaction has been authorized. A high authorization rate is crucial for merchants to build trust with customers and boost revenue.

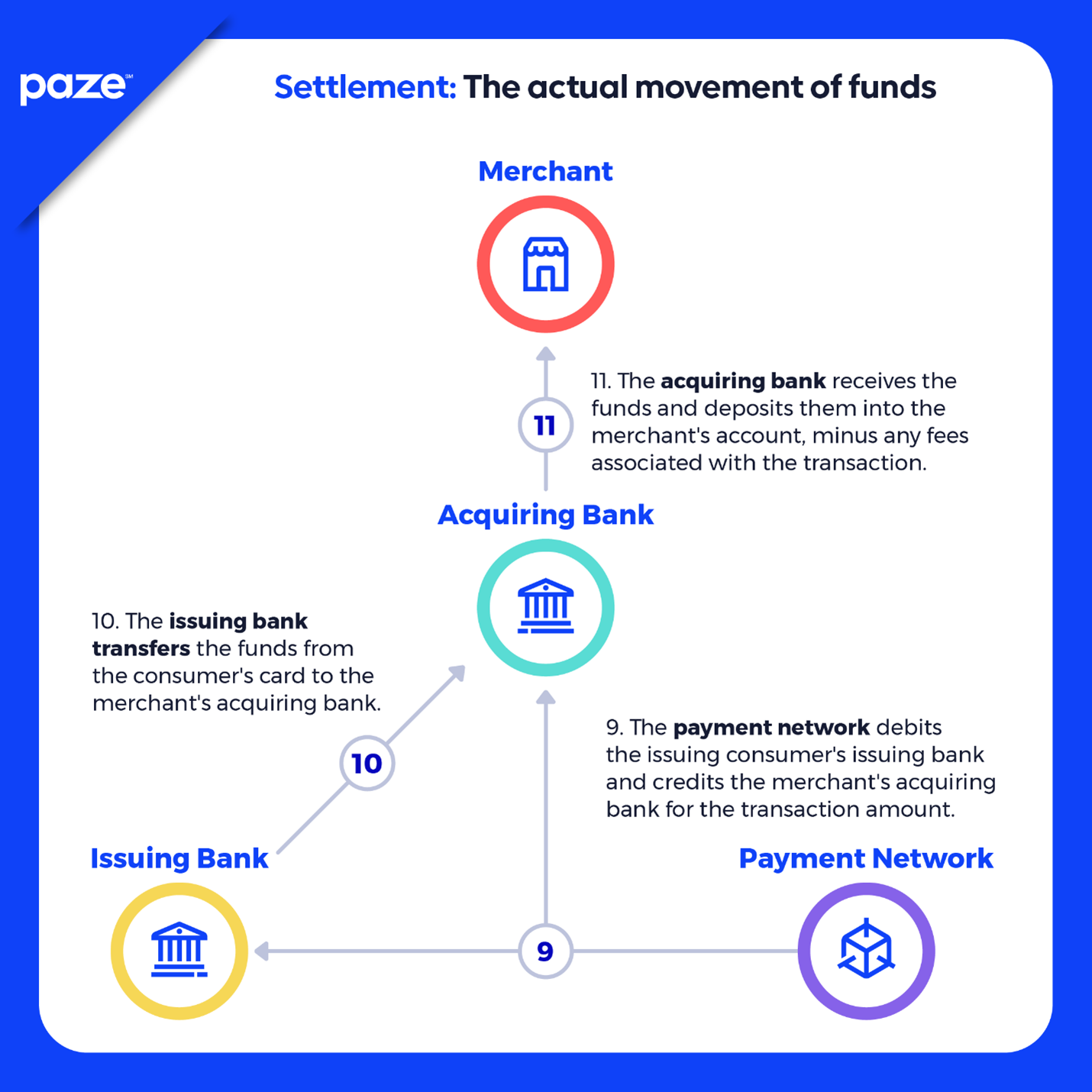

3. Settlement: The actual movement of funds

The actual movement of money happens in the clearing and settlement process, which can take 1-3 business days.

The card network calculates the amounts owed between the issuing and acquiring banks. The issuing bank transfers funds (after deducting interchange fees) to the acquiring bank. The acquiring bank then deducts the Merchant Discount Rate (MDR)—which bundles the interchange fee, the acquirer’s processing fee, card network fees, and any payment gateway fees—and deposits the rest into the merchant’s account.

4. Loyalty: Additional players and value

Beyond processors and banks, Payment Service Providers (PSPs) simplify payments by bundling processing, acquiring, and fraud management services.

For larger merchants, Independent Sales Organizations (ISOs) and Merchant Service Providers (MSPs) bridge the gap—connecting them to acquiring banks, payment services, and technology solutions.

While PSPs, ISOs, and processors heavily influence merchant payment decisions, all players in the ecosystem offer insights to merchants. The more insights merchants can glean from their data, the more equipped they will be to influence customer loyalty.

The intricate interplay of players and processes behind every digital transaction requires choosing solutions that simplify complexity and improve the experience for merchants and their customers. By streamlining checkout, ensuring payment authorizations, facilitating efficient settlement, and unlocking payment data to drive loyalty, solutions like Paze empower merchants to thrive in the digital landscape.

Interested in implementing Paze or establishing a partnership? Contact the Paze team.

at checkout?

at checkout?